Early bull rally indications for French stocks.

CAC40 or also FRANCE40 is the benchmark stock market index in France. It is made up of 40 of the largest and most liquid French companies, listed in Euronext Paris. Since the end of September 2022 until mid April the index rose with more 1700 points, or roughly 35%. This strong and lasting bullish momentum was backed by better than expected company earnings and reducing levels of inflation. For the past few weeks however we notice a correction taking place.

From its April peaks, CAC40 dropped with almost 7%. This 500 point drop took place in the context of lack of agreement by the two political parties in the US regarding the countries debt ceiling. Political uncertainty often results in fear and investors dont take long before they start looking for safe harbour assets. What contributed further to the April -May sell off is the usual profit taking before the end of the second quarter. From a historical perspective the summer rally from June to September is normally preceded by a correction.

Looking from the technical analysis point of view, FRANCE40 dipped below the 7200 mark, which sits very close to the 23.6 Fibonacci retracement level. Often this level has been used as level of support and entry for new buyers, who would push the asset higher. The oscillator indicators such as CCI and %R also indicated a badly oversold market. This is a further indication that 7200 could be the bottom of the correction.

The first 2 days of June marked a 200 point jump from those oversold levels reaching a weekly high of 7300. Today the asset pulled back testing again the 7200 zone, but did not drop below the important 23.6 Fibonacci level. Technical analysis suggest a continuation of the longer upward trend. At the same time, the US resolved their debt issue, meaning that from the fundamental perspective there is no more fear factor that would cause a further sell off. Should it test its previous high, investors can expect a rise with up to 500 points over the next few weeks, reaching above the 7600 mark.

Read more stories

December 10, 2023

Published by Sharesdealing Team on December 10, 2023

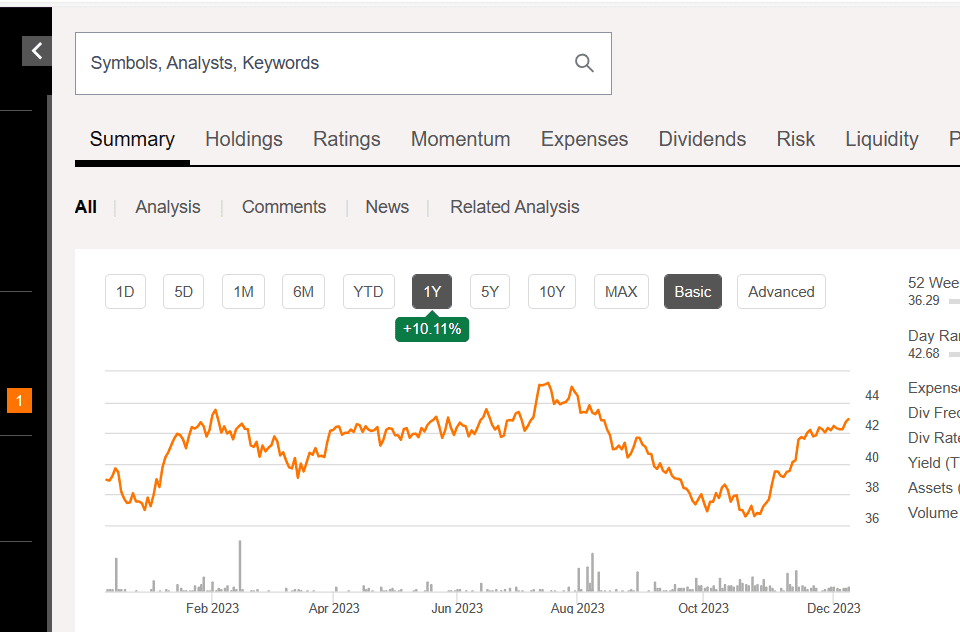

EWN closed on Friday at almost $43! Big names such as ASML, ING, Heineken and Prosus were some of the drivers behind the fantastic rally. Investors […]

December 10, 2023

Published by Sharesdealing Team on December 10, 2023

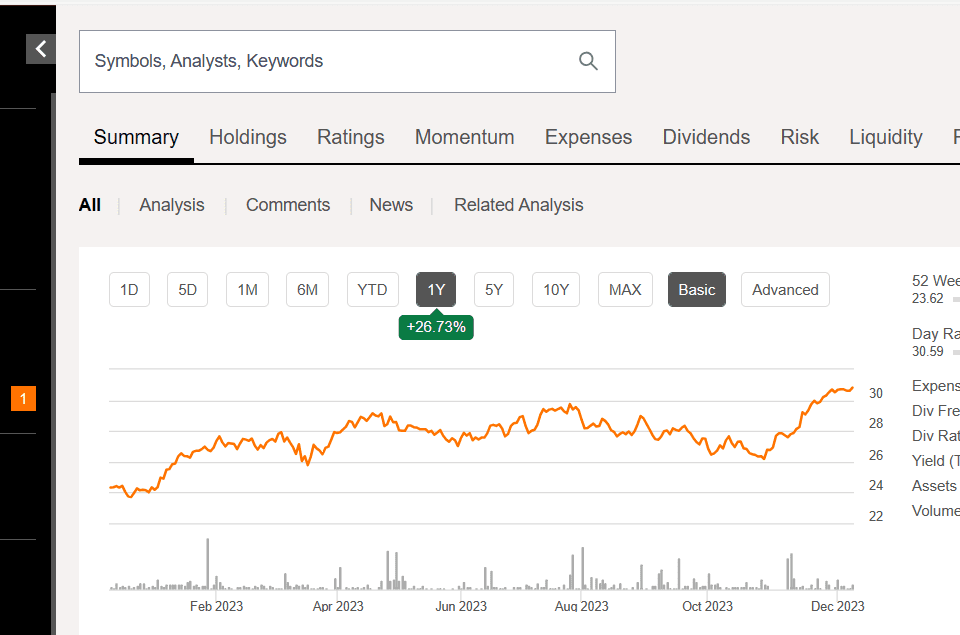

iShares MSCI Spain closed on Friday above its 4 year high! Investors made huge profits already, but it looks like the bulls are still in total […]

December 10, 2023

Published by Sharesdealing Team on December 10, 2023

With a ticker EWI, this ETF is holidng some of the most popular names in Europe and also in the world. Stellantis, Ferrari, Unicredit and Enel […]